Understanding Dental Insurance in Everyday Life

Dental insurance is one of those things many people hear about but do not fully understand until they actually need it. In simple words, dental insurance helps cover the cost of dental care so that regular checkups, cleanings, and treatments do not become a financial burden. Teeth are a vital part of overall health, yet dental care can be expensive without coverage. Dental insurance exists to make oral healthcare more affordable, predictable, and accessible for individuals and families of all ages.

Why Dental Insurance Is Important for Long-Term Health

Many people think dental care is optional, but oral health is deeply connected to overall health. Problems in the mouth can lead to infections, pain, difficulty eating, and even heart-related issues if left untreated. Dental insurance encourages regular visits to the dentist, which helps catch problems early before they become serious or costly. By having dental insurance, people are more likely to take preventive care seriously rather than waiting until pain forces an emergency visit.

How Dental Insurance Works Step by Step

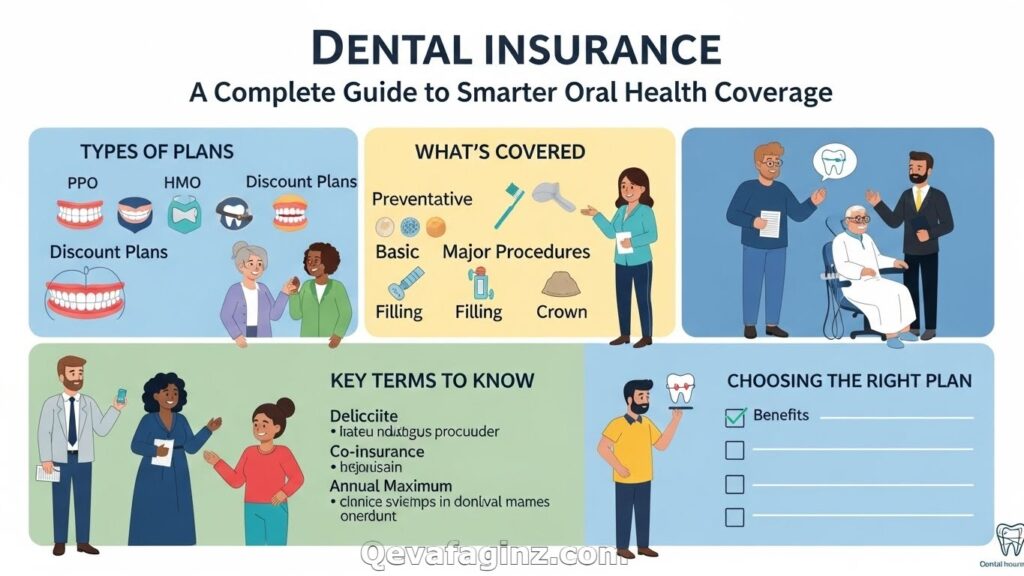

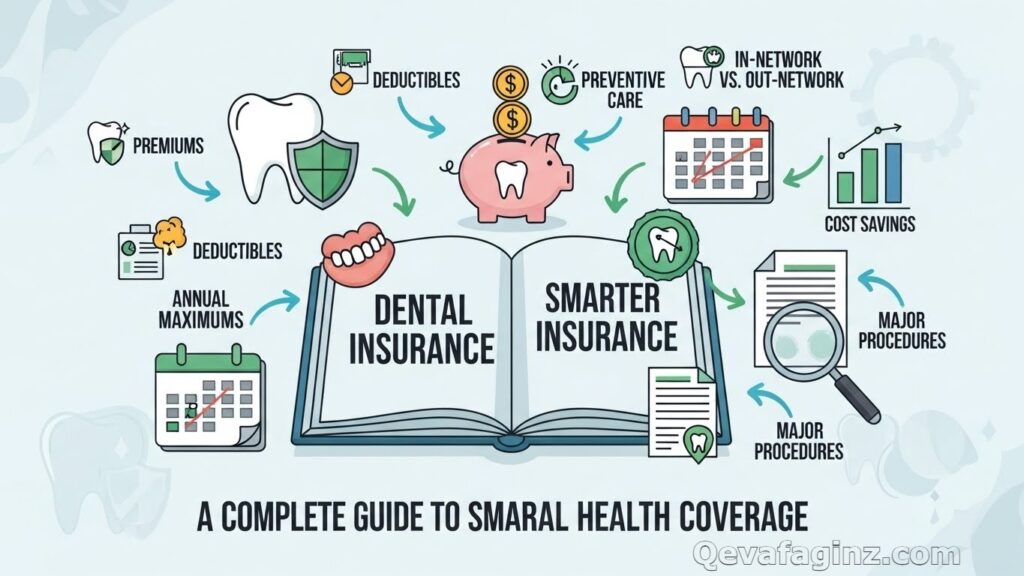

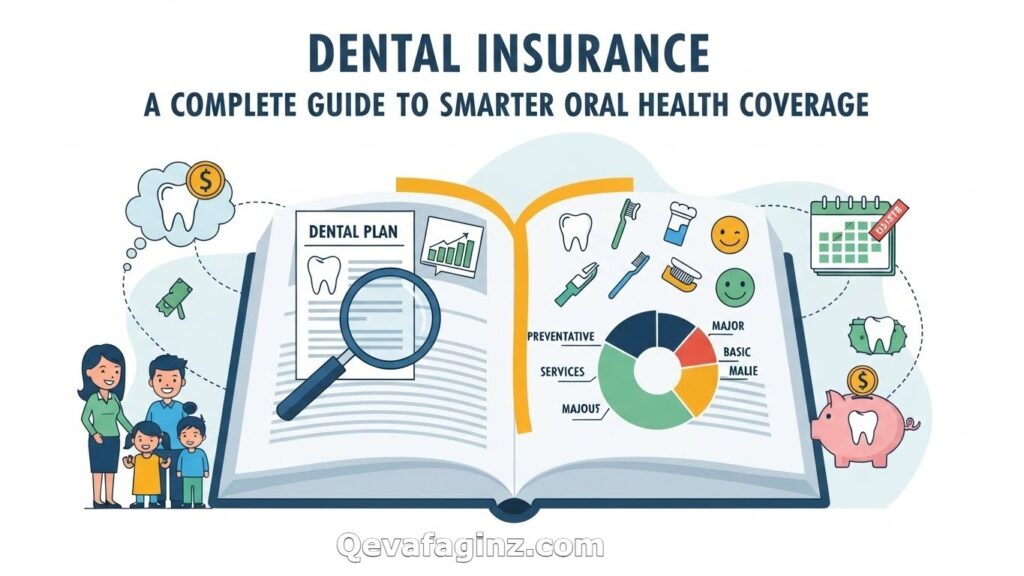

Dental insurance usually works through a monthly premium that you pay to stay covered. In return, the insurance provider helps pay for dental services according to the plan’s rules. Most plans divide services into preventive, basic, and major categories. Preventive care often includes cleanings and exams, basic care includes fillings and extractions, and major care includes crowns or root canals. Understanding how your plan pays for each category helps you make smarter dental decisions.

Types of Dental Insurance Plans Available Today

There are several types of dental insurance plans, and each works a little differently. Preferred Provider Organization plans allow you to visit dentists within a network at lower costs. Health Maintenance Organization plans often require you to choose a primary dentist but usually have lower premiums. Indemnity plans offer more freedom in choosing dentists but may cost more. Knowing the differences helps you choose a dental insurance plan that matches your lifestyle and budget.

Dental Insurance vs Paying Out of Pocket

Paying out of pocket for dental care can seem manageable at first, but costs can add up quickly when treatments are needed. A single dental procedure can sometimes cost more than a year of insurance premiums. Dental insurance spreads costs over time and reduces sudden financial stress. While not every procedure may be fully covered, having insurance usually means paying much less than someone without coverage.

What Dental Insurance Usually Covers

Most dental insurance plans focus heavily on prevention. Cleanings, X-rays, and routine exams are often covered at little or no cost. Basic procedures like fillings are partially covered, while major treatments usually require higher out-of-pocket costs. Although coverage varies, dental insurance generally helps reduce expenses and encourages consistent care rather than reactive treatment.

Common Dental Insurance Terms Explained Simply

Dental insurance comes with terms that can sound confusing at first. A deductible is the amount you pay before insurance starts helping. A copayment is a fixed amount you pay for a service. Annual maximum refers to the highest amount the insurance will pay in a year. Understanding these basic terms makes it easier to read your policy and avoid unexpected costs.

Choosing the Right Dental Insurance Plan

Choosing dental insurance is not about picking the cheapest plan but finding one that fits your needs. If you only need cleanings and checkups, a basic plan may be enough. If you expect dental work like crowns or braces, a more comprehensive plan may be better. It is important to check which dentists are in-network and what services are covered before enrolling.

Dental Insurance for Families and Children

Dental insurance is especially valuable for families. Children need regular dental visits as their teeth develop, and early care can prevent lifelong problems. Many family dental insurance plans offer additional benefits for children, such as fluoride treatments or sealants. Having coverage ensures that parents do not delay care due to cost concerns.

Dental Insurance for Seniors and Older Adults

As people age, dental needs often increase. Gum disease, tooth loss, and restorative procedures become more common. Dental insurance for seniors helps manage these costs and encourages regular dental care even after retirement. Some plans are specifically designed for older adults, offering coverage for dentures and other age-related treatments.

The Role of Dental Insurance in Preventive Care

Preventive care is the backbone of dental insurance. Regular cleanings and exams help detect issues early, saving money and discomfort later. Dental insurance makes preventive care affordable and accessible, which benefits both patients and insurance providers. Healthy teeth mean fewer expensive procedures in the future.

Understanding Waiting Periods in Dental Insurance

Many dental insurance plans include waiting periods before certain services are covered. This means you may need to wait several months before major treatments are eligible for coverage. Waiting periods are designed to prevent people from signing up only when they need expensive procedures. Knowing these rules helps you plan dental care wisely.

How Dental Insurance Saves Money Over Time

While dental insurance requires monthly payments, it often saves money in the long run. Regular care prevents serious problems, and discounted rates through insurance networks reduce overall costs. Even when you pay part of the treatment cost, it is usually much less than paying the full amount without insurance.

Common Mistakes People Make with Dental Insurance

One common mistake is not using dental insurance benefits fully. Many plans reset annually, meaning unused benefits are lost. Another mistake is ignoring preventive visits, which are often fully covered. Understanding your plan and scheduling regular appointments ensures you get the most value from your dental insurance.

Dental Insurance and Employer-Sponsored Plans

Many people receive dental insurance through their employer. These plans are often more affordable because employers share the cost. Employer-sponsored dental insurance usually offers solid coverage for routine care and basic procedures. Reviewing plan details during enrollment periods helps employees choose the best option.

Individual Dental Insurance Plans Explained

For those without employer coverage, individual dental insurance plans are available. These plans offer flexibility and independence but may cost more. However, they still provide valuable protection against high dental expenses. Individual plans are ideal for freelancers, students, or people between jobs.

The Future of Dental Insurance

Dental insurance continues to evolve as healthcare needs change. More plans now focus on preventive care, digital tools, and flexible coverage options. As awareness of oral health grows, dental insurance will likely play an even bigger role in overall wellness strategies.

Final Thoughts

Dental insurance is more than just a financial product. It is a tool that supports healthier lives by making dental care accessible and affordable. Whether for individuals, families, or seniors, dental insurance helps reduce stress, prevent disease, and protect smiles. Understanding how it works and choosing the right plan empowers people to take control of their oral health with confidence.